Almost every employee of firms and various enterprises dealing with finance is facing the need for reporting to the tax. Now most such actions are carried out using special programs or services. In this article we want to talk about the most popular applications that are suitable for the task.

Astral report

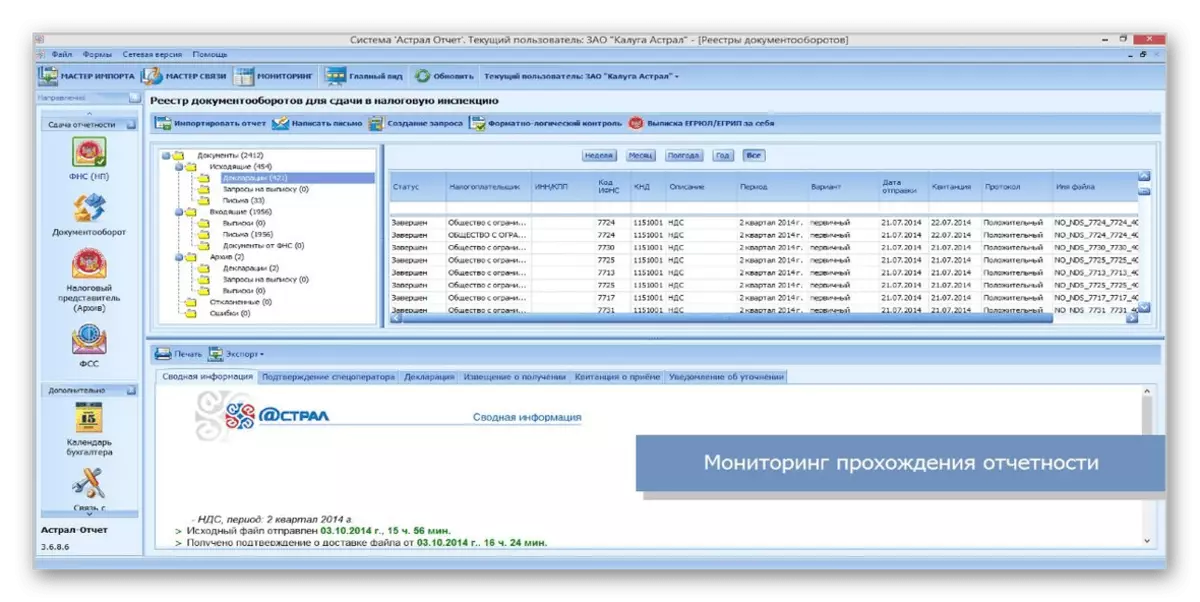

The first program of our today's material has become an astral report. This solution, like most of the like, is distributed in a monthly or annual subscription, so be prepared for the acquisition. The main drawback is the inability to familiarize yourself with all the functions of the software before purchasing, however, for companies in need of such software, it is almost never necessary. After installing the Astral, the report you immediately fall into the main window. Here you can choose one of the 200 design options that meet the standards, so you can only fill out forms according to personal requirements. Each form is relevant, as the developers update them in time, as for the rules of the controlling bodies.

One of the main features of the Astral Report is to control the files sent. The program will not allow random to send shape with errors or incorrectly filled with forms, which is why many employees receive fines. All users who have licensed copies of the program will be combined into one group and will be able to exchange documents among themselves, which also applies to counterparties. Developers offer different tariff plans for individual organizations and types of structures, so we recommend learn features on the official website to then choose the optimal assembly.

Download Astral Report from the official site

Kontur.Exter

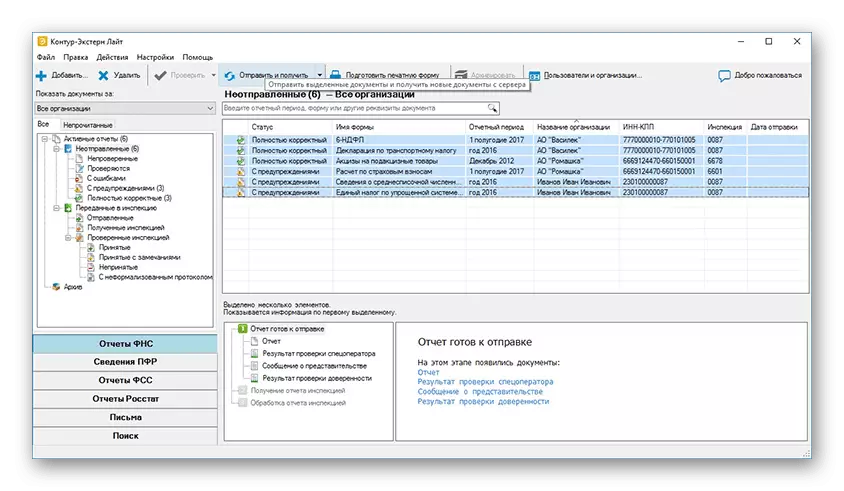

The following contour program. External is like large businesses and small businesses, since functionality allows you to adapt the work of software in accordance with the requirements of users. This solution is suitable for sending reports in the FTS, PFR, FSS, Rosstat, RAR and RPN, and also allows you to view a list of all ready-made documents online. All types of reporting and filling form are regularly updated in accordance with the rules of services, and in the event of errors when filling out, the built-in option will help correct them in automatic mode.

If you are interested in making payments through the contour. Experience, the tool there will allow you to cope with this task automatically, by filling out almost all forms, and you will only need to verify them and send the document to the recipient. This software has built in the reference base, which gives you the opportunity to get answers to existing laws, and also employs round-the-clock support. Contour. Expercisus is available for download on the official website, where you first need to choose a tariff plan and carefully read with all the functions present.

Download outline. Experience from the official site

Additionally, we note that on our site there is a separate manual, which describes in detail the installation of the reviewed program for Windows operating systems. We suggest read it if you have chosen the contour. Experience as software for sending reports to the tax.

See also: Installing the contour program. Experience on a computer

SBI

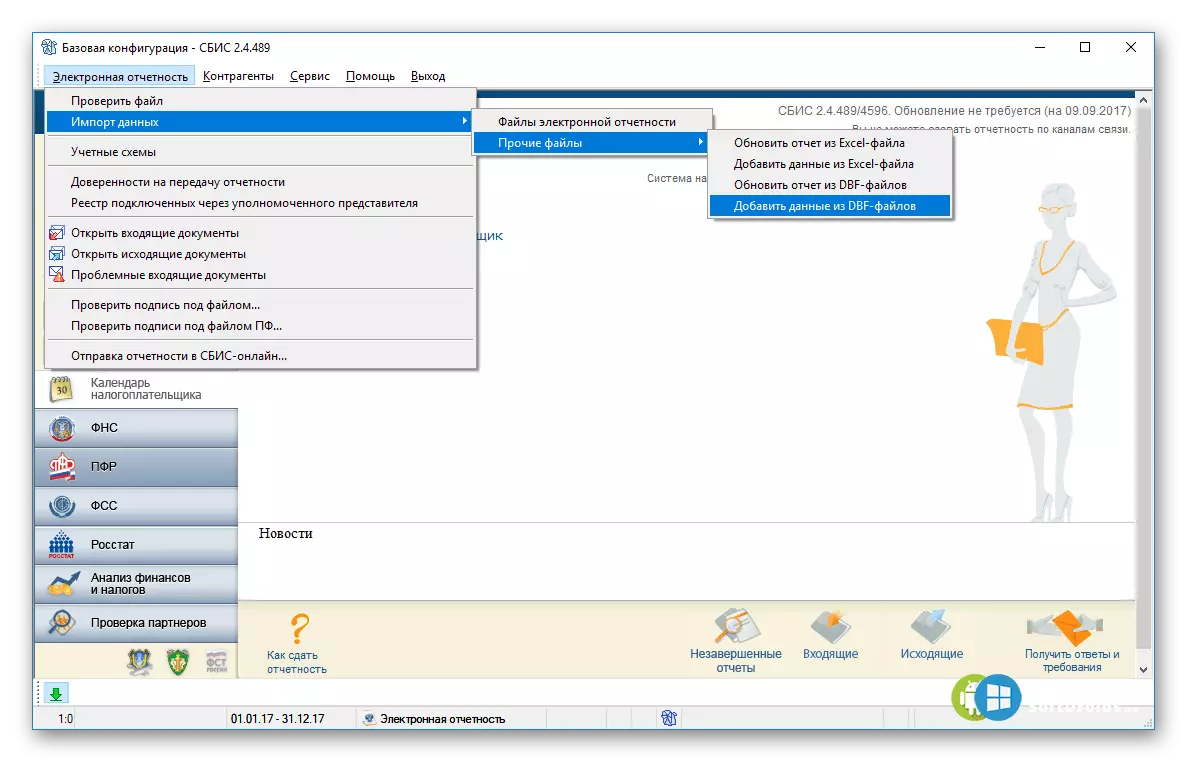

SBI is another popular application for reporting in electronic form. With it, you can quickly make a form and tax by selecting the appropriate template. However, in fact, the possibility of SBI is practically not limited if we are talking about doing business. There are all the necessary tools intended for automation of shops and pharmacies, restaurants and other food institutions, as well as for various businesses from the provision of services and entertainment. You can easily follow all orders, track the state of the enterprise and make up various documents for sending to known services.

Most documents fully comply with the format "on paper" and are suitable for all industries and companies of various levels. As for the work of the accountant, which will issue reports, a specialized calendar will be created for him in the SBI, and the notifications of the upcoming work will come to e-mail or SMS. Reports on government agencies algorithms are checked, so in the results you can be confident a hundred percent.

Download SBI from the official site

When considering the previous program, the contour. Andster, we submitted a reference to another material on our website, where the principle of installation is described in detail. For SBI, there is also a corresponding manual, to study which you can by clicking on the link below.

Read more: Installing the SBI program to a computer

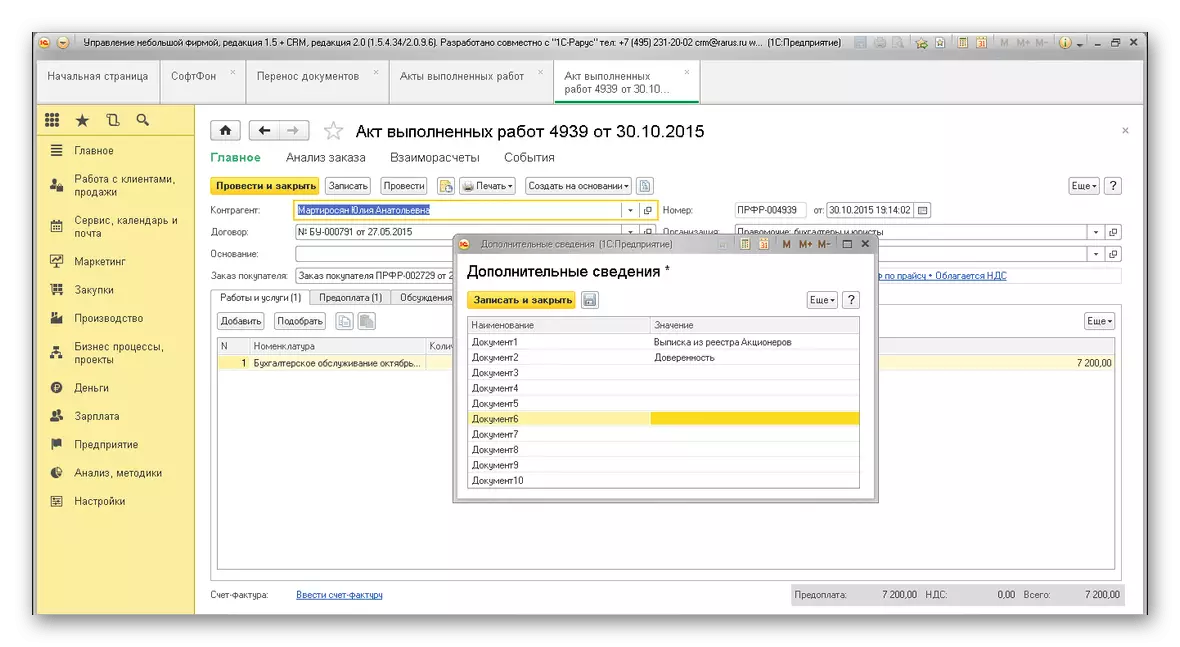

1C reporting

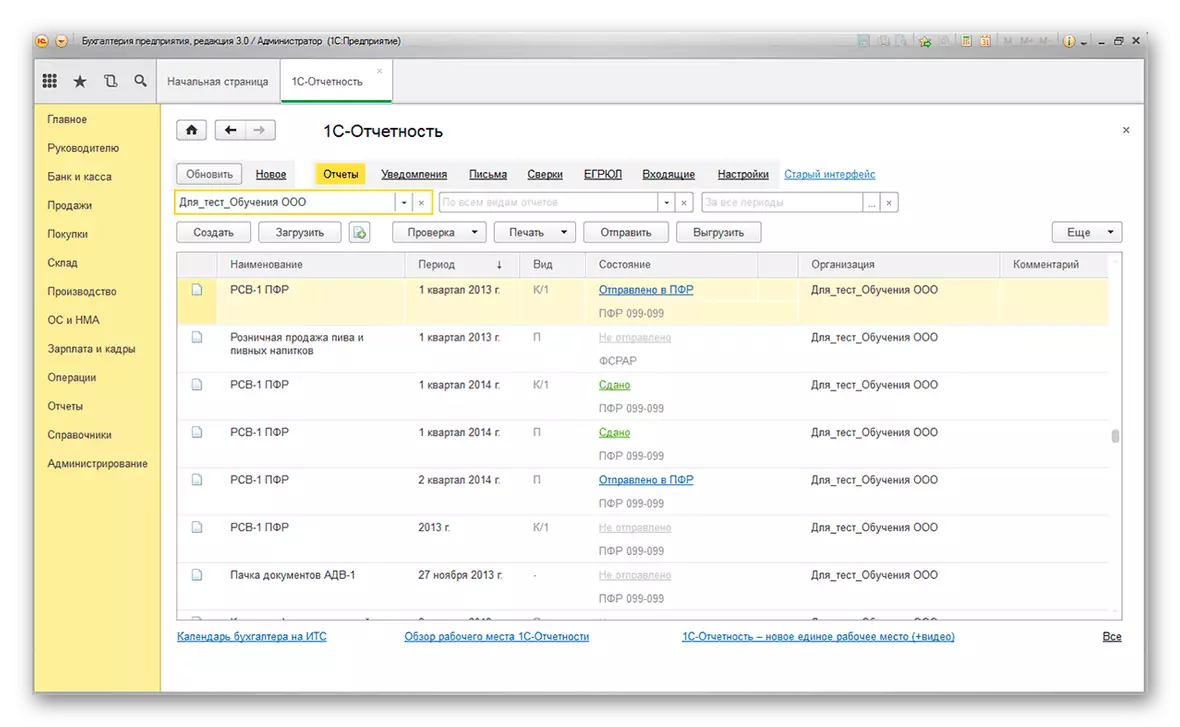

Almost every user who faced the need to conduct various documentation and business through special programs, knows about a comprehensive decision from the company 1C. Today we take into account a separate module called 1C reporting. Through it, it is possible to send reporting in almost all controlling bodies of the Russian Federation, including FTS, PFR, FSS, Rosstat, Rosalkogol Region, Rosprirodnadzor and FCS. Additionally there is a tool that allows you to quickly execute extracts from the EGRUL / EGRIP.

The main difficulty in working with 1C occurs during the connection if the user decides to implement it independently. To do this, a special electronic key must be purchased, and then an installation is installed using authorization. If the office is located in the coverage area of the company, the company's specialists will help to deal with this, and one year later the license will be extended on paperless technology by the company's independently system administrator, where 1C reporting is established, or by the same specialists from developers. We recommend reading the basic options in more detail with the main options of this software by clicking on the link below.

Download 1C reporting from the official site

Taxa reporter

Taxa reporter is the last program we want to tell in today's article. It functions approximately by the same principle as the decision described above, and also supports document management with all already mentioned government agencies. After purchasing this software, the user will need to install an additional tool to the computer through which the input will be carried out using a pre-created electronic digital signature. This is the most difficult stage, because not all previously faced with the execution of such a task. However, on the official website of Taxok, you can easily find all the necessary instructions and figure it out with this aspect.

Everything related to reporting is applied in the taxi report to the usual standards, as well as the reception of answers from FTS, Rosstat, FIU and FSS. Additionally, this software can generate files with reports on reports and check the available documents by finding the errors if they are there. Applicated by the taxi reporter is also paid under the license to be renewed. Before it acquisition, we advise you to study the tariff plans and opportunities to make sure that it is completely suitable for you.

Download Tax Account from the Official Site

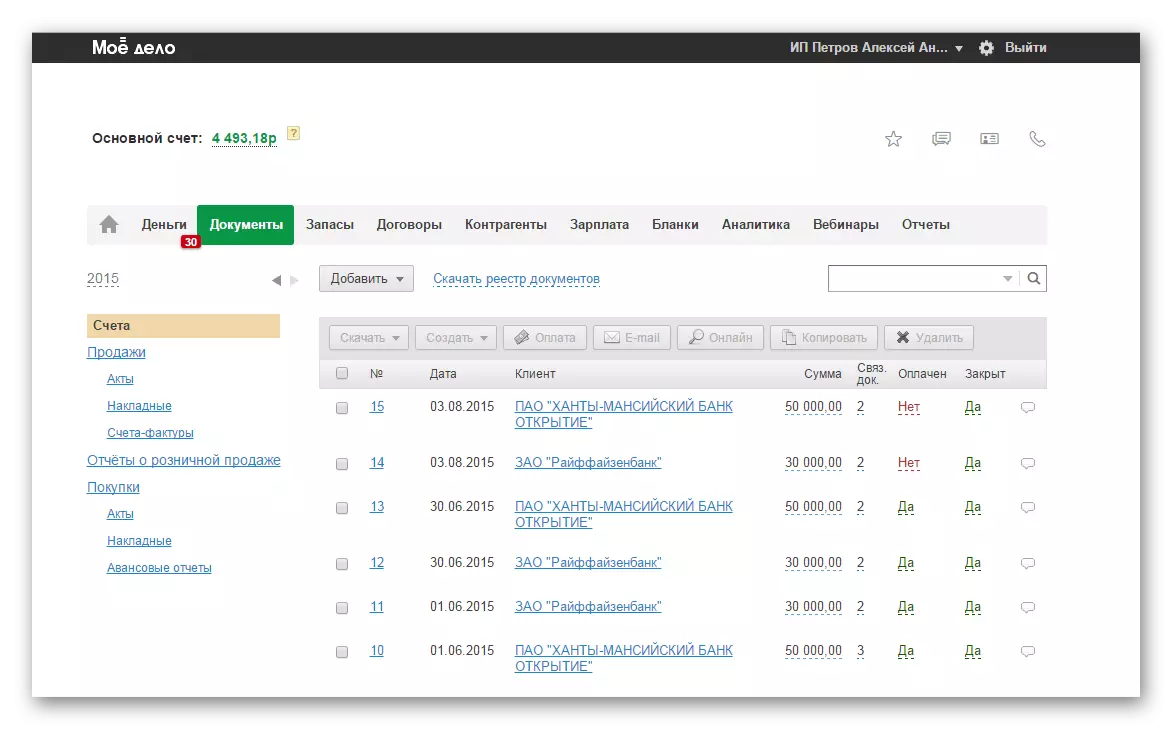

Online services

At the end of this material, we want to clarify that now many users refuse full-fledged tools in the form of software and switch to online services. They are not included in the subject of our review, so we will affect them only superficially. Each such web resource functions approximately the same, and also offers a similar set of options. To interact with the site, it will only be necessary to purchase a license by creating a profile along with this, and then log in by entering personal data. In the above tab, the example of which you see below are mainly interaction, including reporting. We recommend special attention to pay my business, sky and elb on sites, because they are the most popular and comply with standards.

Now you are familiar with the list of programs suitable for reporting to the tax. As you can see, each of them has its own features, but at the same time standards and complies with state regulations, so the user remains only to choose the software in accordance with personal preferences.